By Kyle Brandon

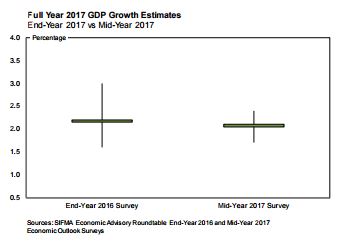

On Monday, SIFMA’s Economic Advisory Roundtable announced it slightly weakened its GDP outlook for 2017 to 2.1%. The following is a Q&A with Kyle Brandon, Managing Director, Director of Research and staff advisor to the Roundtable.

SIFMA's Economic Advisory Roundtable lowered its GDP forecast from 2.2% to 2.1%. Was there a significant change in its view?

The Roundtable's outlook is slightly weaker numerically speaking, but is essentially the same as our estimate this past December. As it did then, the Roundtable considers business confidence to be the most important factor impacting U.S. economic growth, followed by U.S. fiscal policy (of note, the Roundtable's estimate for business capital investment strengthened considerably from 2.7% to 4.4%). This time around, Federal Reserve interest rate actions were noted as a distant third factor, whereas private credit market conditions made the list in December.

Risks to the forecast were more dispersed than our December survey, which focused on fiscal and trade policies. Fiscal stimulus, sooner-than-expected tax reform, and business capital expenditures were the most often cited risks on the upside. On the downside, policy uncertainty/failure, tight financial conditions and geopolitical risk were all noted.

The Roundtable expects the Federal Open Market Committee will raise rates on Wednesday. What's the view for the rest of the year?

All but one respondent agreed the FOMC will raise rates this week. Similarly, all but one respondent expected two hikes in full-year 2017 inclusive of the June hike. Favorable labor market conditions were considered to be the most important factor; inflation and inflationary expectations were also taken into account. One respondent pointed out that political conditions could also be a factor.

Looking forward to 2018, there was much more variance. Half of respondents expect three rate hikes, with the other half split amongst one, two or four hikes.

The unemployment rate is at a near ten-year low, and continued improvement is expected. How does that affect the rest of the forecast?

Employment is expected to continue improving, and on a stronger basis than the Roundtable forecast in December. The Roundtable is now predicting a 4.4% unemployment rate in 2017, down from December's 4.7% forecast. This plays a role in the muted core inflation outlooks, where unemployment was cited as the dominant factor. One respondent noted that "each percentage point drop in the unemployment rate adds less to inflation risk compared to the past."

The Fed has continued to maintain its accommodative financial conditions by reinvesting proceeds from its Treasury, agency and mortgage securities holdings while noting in its last minute that there is an expectation that will change later this year. When does the Roundtable expect this reinvestment policy to change?

The entire Roundtable expects a change, with some forecasting as soon as the third quarter and the majority in the fourth quarter of 2017. The change will likely be implemented through a gradual phase-out of reinvestments and be based on a qualitative judgment about economic and financial conditions.

What policy changes under the Trump Administration could have the largest impact on the Roundtable's predictions?

Tax policy and infrastructure are expected to have a significant positive impact - if enacted. On the flipside, changes to immigration policy and the Affordable Care Act (ACA) would be negative. Tax policy is predicted to have the greatest chance of enactment, followed by changes to trade policies, immigration and the ACA. Only one respondent saw infrastructure policy as likely to be enacted.

The Administration has promised regulatory relief. Are certain financial regulations likely to be targeted?

The Department of Labor's fiduciary rule was considered the most likely candidate for reform, and is expected by mid-2018. The Roundtable was split on the chances for reform of the Comprehensive Capital Analysis and Review (CCAR), leverage rules, prudential capital requirements, and the Volcker Rule. Reforms of the Orderly Liquidation and Securitization requirements were considered less likely. Overall, respondents did not expect any reforms to have significant impact on GDP growth: the majority expected no impact at all, with the rest expecting reforms to add up to 50 bps to their growth outlooks.

Just yesterday, the Treasury Department released recommendations for regulatory reform. This is the first of several reports following President Trump's Executive Order calling for review of the nation's financial regulatory framework and its impact on the markets and the economy.

Download the Outlook

The mid-year 2017 survey was conducted from May 16, 2017 to June 2, 2017. The forecasts discussed in the text and appearing in the accompanying data tables and graphs are the median values of the individual member firms' submissions, unless otherwise specified.

SIFMA's 2017 Economic Advisory Roundtable

Joseph LaVorgna (Chair), Deutsche Bank Securities Inc

Ethan Harris, Bank of America-Merrill Lynch

Michael Gapen, Barclays Capital Inc.

Nathaniel Carp, BBVA Compass

Douglas Porter, BMO Financial Group

Dana Peterson, Citigroup

Michael Carey, Credit Agricole

James Sweeney, Credit Suisse AG

Michael Moran, Daiwa Capital Markets America, Inc.

Christopher Low, FTN Financial

Jan Hatzius, Goldman, Sachs & Company

John Roberts, J.J.B. Hilliard, W.L. Lyons, LLC

Michael Feroli, J.P. Morgan Chase & Co.

Ward McCarthy, Jefferies & Co., Inc.

John Lonksi, Moody’s Analytics, Inc.

Ellen Zentner, Morgan Stanley & Co. Inc.

Lewis Alexander, Nomura Securities International, Inc.

Carl Tannenbaum, Northern Trust

Stuart Hoffman, PNC Financial Group

Scott J. Brown, Raymond James & Associates, Inc.

Tom Porcelli, RBC Capital Markets, Inc.

Stephen Gallagher, Société Générale Corporate and Investment Banking

Barry Bannister, Stifel Financial Corp.

Samuel Coffin, UBS Investment Bank

John Silvia, Wells Fargo Securities, LLC

SIFMA Staff Advisors

Kyle Brandon, Managing Director, Director of Research

Sharon Sung, Assistant Vice President, Research